Coats of many colors

Finish manufacturers are touting tougher powder coatings, mobile robots and louder accent colors, while continuing to address environmental concerns.

Keeping up with coatings is a challenge, especially when everyone from consumers to governments are continually changing the rules. Color trends, environmental issues, costs and even predicted availability are all serious concerns. Manufacturers are coping with global economics and trade agreements, while distributors are dealing with local regulations and EPA mandates. Woodworkers, on the other hand, are watching their industry change daily as they try to predict the next trend and gear up to meet it. So, it’s no surprise that some woodshops are taking a second look at alternative solutions when it comes to coatings.

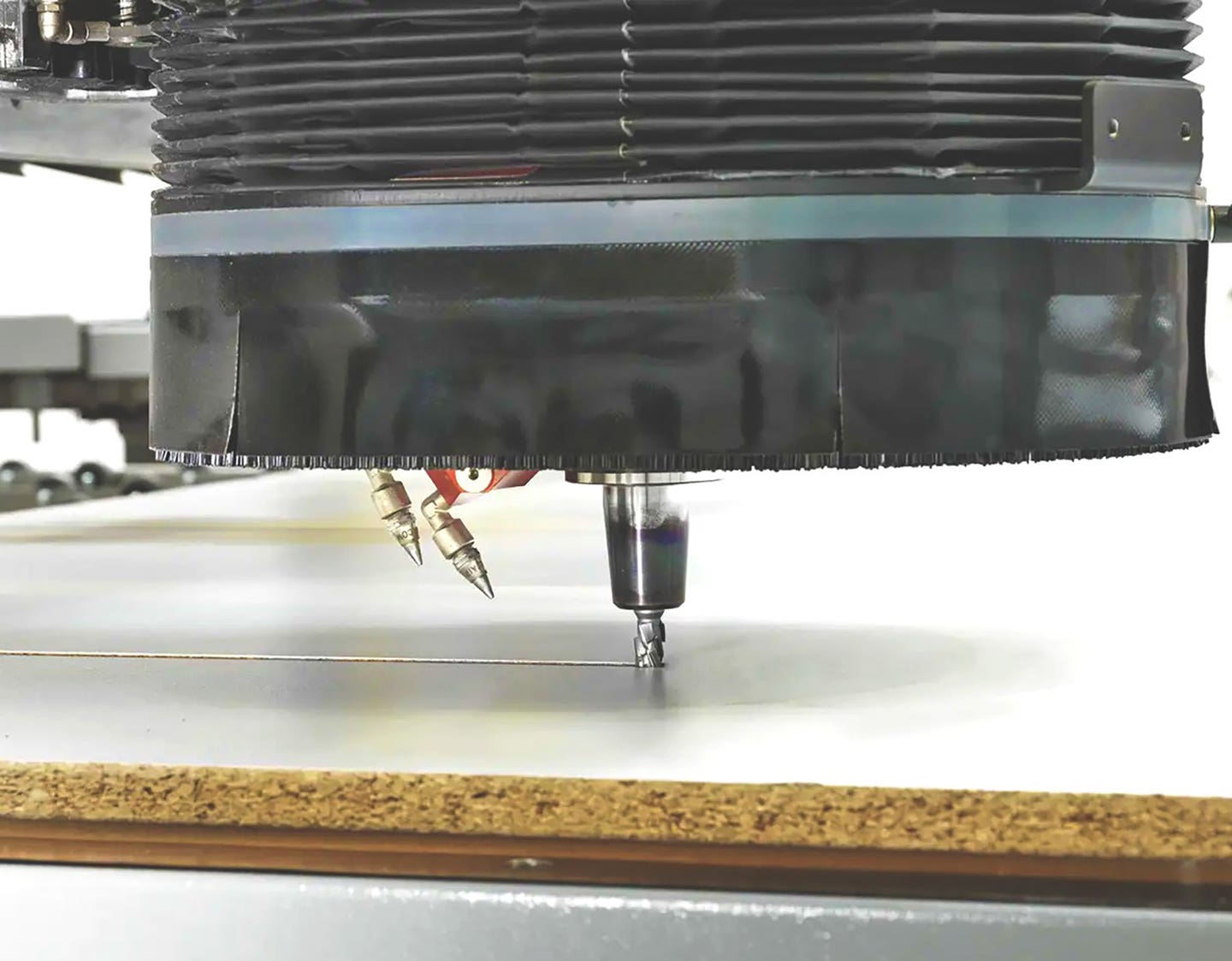

It’s still just a small part of the casework and furniture market, but powder coating is definitely gaining traction. One of the initial challenges with the technology was that the higher its durability was, the lower its flexibility became. That’s an issue when a coating is applied to a substrate such as wood or MDF that responds to environmental changes including humidity and temperature.

Last June, AkzoNobel introduced a new powder product named Interpon Structura Flex, which is both super durable and flexible. Initially focused on coating materials such as aluminum, it means that manufacturers of windows and doors can extend the lifetime and the warranty of their finished products. The company is in the process of investing some $50 million in its wood coatings facility in High Point, N.C., and that will include state-of-the-art production technology as well as a research lab and technical application center. A viable new, tough, powder coating is of immense interest to woodshops and furniture manufacturers that build medical, playground, school, cafeteria and other high-use products. The company has also just released a scratch resistance additive for its Interpon D powder coating.

For shops interested in supplying powder coated products but who don’t have inhouse capabilities, BTD Wood Powder Coating in Brainerd, Minn. provides powder coated MDF wood components. The company’s t.fusion coating delivers a high-quality, extremely durable finish that the company says can’t be duplicated with HPL laminate, melamine, or liquid paint. It’s also an environmentally friendly choice, and users can specify NAUF and FSC-certified MDF as a substrate for LEED projects. BTD’s new ultra.smooth t.fusion finish looks like lacquer or acrylic but is made with eco-friendly powders. The high gloss finish makes a design statement on cabinet door and drawer fronts, furniture accent panels, architectural panels, shelving, or as an alternative to solid surface materials.

Integra Doors in Greer, S.C. touts the very low carbon footprint of powder coating. It emits no VOCs or HAPs, uses no glues or solvents, and all the powder that goes in the oven becomes the finish. The catalytic ovens don’t emit any nitrous oxide or carbon monoxide and are 70 percent cleaner in emissions than an electrical heater. Powder coated doors are free of pigments that could contain heavy metals, produces no laminate or foil for the landfill, and there are no plastics or vinyl involved.

Robots and recycling

In another fast-moving area of technology, AkzoNobel is taking a leadership role in bringing on-site, mobile robots to the coatings world. Looking beyond collaborative spray arms mounted on a stationary base, the company has created a partnership with French startup Les Companions that is focused on developing a mobile, self-guided paint robot. The technology will help finishers complete jobs faster and more efficiently, while simultaneously making working conditions safer. The first robot is currently doing field tests. And the company has introduced a trio of new color matching tools that work with the Salcomix system (an onsite system that lets customers mix paint on demand). The trio includes the PaintFinder Cloud with over 600,000 colors, the high-end Automatchic Vision measuring device, and ColorFinder, a color-matching system that works through a dedicated app. With Salcomix, a woodshop finisher can simply scan the color on an existing cabinet or piece of trim, and the app says which color is a perfect match.

In the U.K., AkzoNobel’s Dulux Trade has launched a new partnership with environmental solutions company Veolia to offer a new matt emulsion made from 35 percent recycled paint. The product, called Evolve, has been tested for five years and is now ready to be commercialized.

Eighteen months ago, the Sherwin-Williams Co. announced a new line of Valspar exterior stain products that is available exclusively through Lowe’s. The new stain comes in 50 nature-inspired shades and “provides all-weather protection in one coat and is available as a clear finish as well as transparent, semi-transparent and solid color stains.” Last October, Sherwin-Williams announced its 2020 Colormix industrial wood forecast. This is built to inspire manufacturers of wood products to create finishes that keep up with shifts in consumer preferences. The company’s forecast team spent a year researching color, design and popular culture trends around the globe, and from that they identified five sets of color trends. These palettes can be explored in detail online at industrial.sherwin-williams.com. And a year ago the manufacturer announced the launch of its Ultra Cure MarGuard Clear Topcoat, which is a UV-cure product.

Color trends

In November 2019, Woodshop News reported on coatings manufacturers’ color choices for 2020. That article revealed that trends have been moving toward nature-inspired soft pastels, but most manufacturers have also been touting a little drama. The result has been a concept for kitchens and baths that relies on a broad swath of soft tones with a few dramatic and often quite loud accents. Philadelphia-based Axalta Coating Systems (axalta.com) has now introduced a new series of color collections that focus on home interior trends, including wood finishing trends. Inspired by runway trends (Moda is the Italian word for fashion), it includes pastels such as muted green, light pink and lavender. But it also includes stronger colors such as deep blue, earth red and mustard yellow.

General Finishes (generalfinishes.com) in East Troy, Wisc. has added a number of colors to its gel stains, and there are now 30 samples shown on the website including Java, which is very popular for upcycling furniture and cabinets. The wood stains are heavy-bodied and don’t penetrate as deeply into the wood as liquid oil-based, wipe-on stains do. This delivers a deep, rich color. For cabinet re-facers and furniture refinishers, the company’s Ready To Match (RTM) stain system is designed to make color-matching a breeze. It consists of ten ready-to-use water-based stains, a clear base, a chip box with 78 color formulas on two-sided color chips, stock color chips and a formula book that is available in print and digital format to calculate any quantity of stain. Woodshops can intermix the stains and base to design rich, deep wood stain colors.

PPG’s architectural coatings are familiar to woodshops under a number of brand names including PPG Paints, Olympic stains, Glidden, SICO paints and stains, Dulux paints, and Liquid Nails adhesives. Glidden did something a little different last fall by specifically announcing that it was not going to name a 2020 color of the year. Instead, the marketing department decided to unveil “the color people actually will use”, which they say is Whirlwind (PPG1013-3). In keeping with the pastel theme that most manufacturers chose, the Glidden color is a cool gray with a touch of blue. The company sees it as an alternative to basic white or beige, and suggests pairing it with navy blue cabinets and quartz countertops. SICO’s 2020 color of the year is Mystic Cobalt, which is a cobalt blue which that label suggests will pair well with white, caramel and yellow.

Orange City, Iowa is home to Old Masters (myoldmasters.com), a wood stain and finish supplier to independent paint, hardware, and specialty woodworking retailers. The catalog includes Fast Dry wood stain that comes in about two dozen colors and can be brushed, sprayed, or wiped on. Oil-based finishes can usually be applied over it in 30 minutes, but dry times can be a bit longer in high humidity, low temperatures, still air, or where excess stain was applied or there’s or a lack of penetration. Fast Dry can be top coated with virtually any finish, including lacquers and conversion varnishes.

With production based in Italy, ICA (icaspa.com) recently introduced its X-Matt coatings in the U.S. These are finishes for interior furnishings that can be applied to any kind of surface and are designed to create high performance, ultra-matte surfaces. The formula has self-healing properties, while maintaining a lower VOC content compared to UV conventional coatings. ICA has also created bi-component pigmented water-based and UV glosses that deliver very high levels of performance and are easy to combine with traditional solvent-based topcoats. In 2019, the company’s X-Matt coatings won both an award for intelligent material and design at Interzum, and a Visionary New Product award at AWFS. An alternative coating called S-Matt is designed to create high performance matte surfaces with self-healing properties, while still maintaining a lower VOC content compared to UV conventional coatings.

Lids, pots and rain forests

Behr Paint’s new paint can doesn’t require a paint key to open the lid. The 100-percent recyclable design features a first-of-its-kind Simple Pour plastic lid that eliminates mess and rust, and keeps paint fresher longer. It will be sold with a complimentary, washable plastic pour spout that snaps onto a 70mm opening on the top of the lid, which can be re-sealed with a simple twist-off cap. For those who prefer to dip their brush directly in the can while painting, the new lid can be removed the traditional way as well.

The French manufacturer Sames Kremlin has U.S. headquarters in Plymouth, Minnesota. The company has introduced a new fluid heater, the Magma 500, which is intended for high-pressure, heavy-duty applications. Its stainless-steel design is compatible with most coatings and especially so for high solids as it minimizes pressure loss and allows high-flow output. The Magma heater range is available up to 500-bar (7,250 psi). It has precise controls that maintain the material temperature, and a temperature limiter for safety. The modular design makes it possible to replace the lower fluid body without changing the electrical modules, which makes repairs a lot less expensive.

Unearthed Wood Finishes (uneartherpaints.com) in Steamboat Springs, Colo. makes coatings with natural ingredients and minimal processing. They are designed to return to their natural cycles at the end of the paint’s useful life. The company offers a Hard Wax Oil that is mostly used as a floor finish, providing a natural alternative to polyurethane. It can also be used as a hard finish on furniture. Safflower Wax is used for the final treatment of interior wooden surfaces such as furniture, doors and wood paneling. And UWF’s Carnauba Wax formula can be used as an additional layer of protection on wood flooring during the finishing process or can be added to a regular floor care regimen. All products are biodegradable, VOC free, manufactured in a carbon-neutral facility, and shipped via carbon-offset transport. For every square foot of finish a woodshop purchases, Unearthed Paint purchases one square foot of rain forest and donates it back to indigenous peoples that have responsibly lived on the land for thousands of years.

Gemini Industries (gemini-coatings.com) in El Reno, Okla. offers a complete line of wood coatings including conversion varnishes, pre-catalyzed lacquers, stains, primers, sealers, urethanes, acrylics, waterborne products and exterior wood stains. The company is employee owned, and its Hydro-Pure waterborne coatings are completely formaldehyde, HAPs and odor free, plus they have extremely low VOCs. Gemini says that Hydro-Pure is tough, endurable, environmentally friendly and easier to apply than most low VOC solvent-based coatings, with no need for costly thinners.

Woodshop owners who wish to learn more about coatings can check out a very helpful page on the Hardwood Manufacturers Association’s site (hardwoodinfo.com) that is essentially a quick primer on all of the available options.

2020 coatings industry overview

Global economics are affecting the coatings industry as they never have before, and North American furniture and casework manufacturers are not immune.

According to the Italian research company Centro Studi Industria Leggera Scrl (CSIL, online at csilmilano.com), a deep shift has taken place over the past few decades which has left the U.S. with just 14 percent of the global furniture market, and the Asian Pacific segment with an impressive 55 percent. One result of that is a trend from occidental to oriental aesthetics, where traditional Western design is going to be increasingly influenced by Chinese, Indian, Korean and Japanese aesthetics, among others.

The current animosity in China/U.S. trade is also a factor of change for the coatings industry. Many European and American companies have been importing product from China or manufacturing there. Now they’re switching to, or at least researching other options such as Vietnam and Thailand. Such disruption affects supply and costs, and thus pricing.

A second shift is internal, a switch from clear coats to colors in the American market that has allowed casework builders to use more economical paint-grade materials rather than solid hardwoods. As a result, the cabinet industry is encouraging growth in opaque rather than transparent finishes through both online catalog offerings and physical showrooms.

Also, a factor is the continually growing eco-sensitivity of the coatings industry, both in terms of manufacturing practices and consumer values. Those ecological concerns have an indirect impact beyond the obvious. For example, some global sources of raw wood have been restricted or curtailed and this, too, has affected the choice of materials being used by the cabinet and furniture industries. It’s often easier now to source manmade paintable materials than it is high quality natural woods.

Consumers are also changing the playing field as they discover new textured laminates, advanced foil graphics and other alternatives to sprayed clearcoats. They are also demanding low or no VOCs, no formaldehyde and biodegradable waste. Wood industry coatings are still about two-to-one solvent over waterborne, but that balance is changing at a steady pace in large part because of public opinion. Ironically, China is now beginning to assume a leading role in the switch from solvents.

But despite all the changes, the use of coatings worldwide is still advancing steadily. In part, that’s a response to population growth and consequent new housing starts and remodeling worldwide, but it’s also due to growing economies in the Pacific rim. While the value of American wages continues to stagnate or decline (the Bureau of Labor Statistics reports that the purchasing power of production and nonsupervisory employees in March 2019 was at the same level as it was back in October 1972), the middle class in China continues to grow and prosper. And despite a sizeable adjustment in its GDP over the past few years, Chinese consumer growth is still rising at about 8 percent annually. Real estate is by far the strongest investment opportunity for Chinese wage-earners. As they continue to earn more, buy more, build and remodel, they continue to fuel and influence the global coatings market.

This article originally appeared in the March 2020 issue.